Data Disasters: Is Supplier Data Hindering Performance?

Editor’s note: This is the third article in a series, “Data Disasters Versus Data Dynasties,” authored by data consultants and engineers from IBM’s Procurement Analytics as a Service team. The series covers common downfalls that procurement organizations make with data, as well as how organizations develop a winning data strategy. The next article will appear on October 21.

The previous articles: “Data Dynasties and Data Governance” and “Data Disasters: Hidden Risks Cost More Than You Think.”

***

What if the biggest threat to your procurement performance isn’t a supplier delay, but poor and insufficient data within your systems? If your organization lacks in-depth supplier information, you are not alone.

According to EcoVadis’ 2024 Sustainable Procurement Barometer, only 50 percent of organizations report having visibility into half of their Tier-1 suppliers. That percentage drops to just 20 percent for Tier 2, and even less for Tier 3. Clearly, the challenge of collecting and integrating supplier data into procurement processes has proven persistent and complex.

If your supplier data (or lack thereof) hinders your business performance and proves difficult to manage, you may be experiencing a data disaster. Turn your supplier data from a liability to a competitive advantage by using practical strategies for (1) identifying and prioritizing supplier data types, (2) recognizing common data pitfalls and (3) building a data dynasty through modern governance and technology.

What Supplier Data Matters and Why

Supplier data is the foundational information a company collects on its supplier base — from contact and financial information to performance metrics, risk indicators and compliance status.

Understanding a supplier’s performance and its role in the broader industry ecosystem is essential to making smart, informed procurement decisions.

While traditional tools like the historical spend cube offer a clear path to value, supplier data often lacks the same visibility and education around its strategic potential. As a result, many organizations overlook its importance, leaving a significant opportunity untapped.

Supplier Data Types

The first step is understanding the diverse forms of supplier data available.

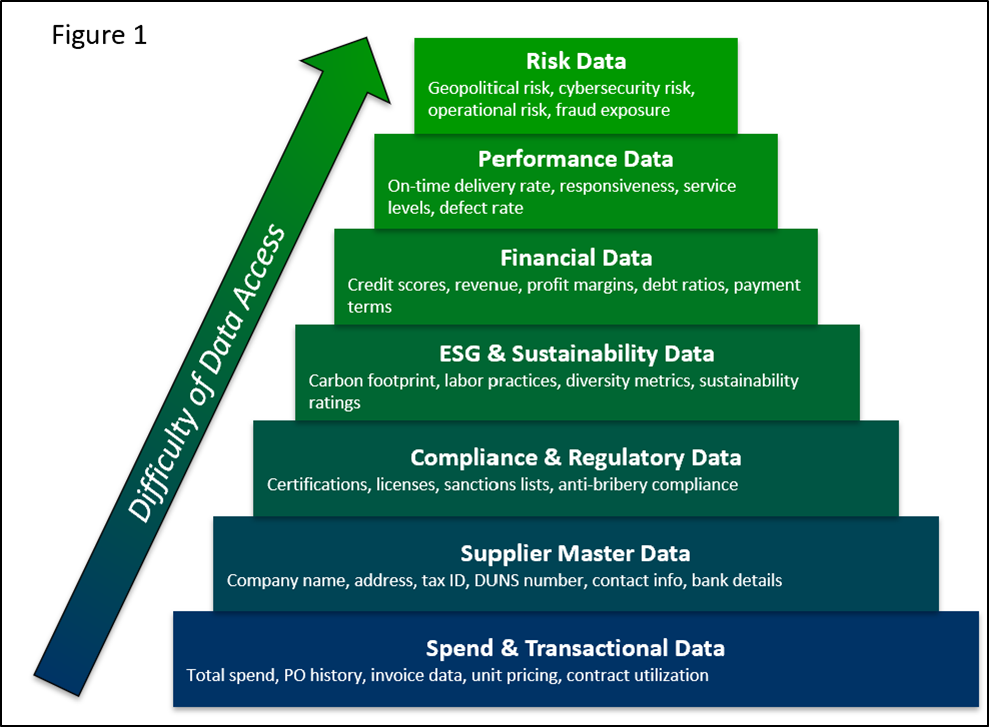

As demonstrated in the pyramid below, supplier data can vary significantly as to ease of access. Transactional data and supplier master details are typically easy to extract from ERPs or data lakes and are essential for day-to-day sourcing and spend analysis. Compliance and regulatory data, often collected during supplier onboarding or audits, help keep fines and litigation costs to a minimum.

(Courtesy of Benjamin DiPiazza and Jessie Smith)

Moving up the pyramid, strategic value increases, but so do challenges in data availability. For example, financial and performance data are critical components of supplier scorecards and supplier optimization, yet lack of supplier disclosure and limited automation of these data flows often creates a barrier to access.

Increasingly important to procurement strategies, risk data is utilized by leaders looking to bolster supply chain resiliency for better contingency planning and strategic sourcing. Even so, it can be difficult to collect, measure and maintain over time, often requiring costly third-party solutions.

Supplier Data Prioritization

Effectively managing supplier data starts with knowing where to focus your efforts.

With limited resources and growing data availability, organizations must prioritize which data to collect, where to source it, and when to invest in third-party sources.

Our top recommendations for navigating the supplier data curation process:

Apply the 80/20 rule to focus on strategic suppliers. When managing supplier data, not all suppliers require the same level of attention. The 80/20 rule is a helpful guide — 80 percent of spend typically comes from just 20 percent of suppliers. These top-tier strategic suppliers should be a priority for high-quality, regularly updated data collection.

While some data types (legal documentation, for example) may be needed across the board, more detailed and higher-cost data types, such as risk analytics or performance benchmarking, should be prioritized for your most critical suppliers.

Prioritize data types by purpose and risk. Not all data serves the same function, so it’s essential to prioritize it based on usage and compliance requirements. Start by collecting data required by law or regulation — for example, for Responsible Business Alliance (RBA) compliance.

Next, focus on risk-related data, especially for companies operating in high-risk regions. Finally, gather decision-making data that offers strategic value, such as supplier ownership changes or industry trends.

Decide when to buy data versus request it. Determining when to buy third-party data versus requesting it directly from suppliers depends on how the data will be used. Purchased data is ideal for benchmarking and industry comparisons (such as evaluating supplier diversity against industry peers).

Requesting data directly from a supplier can be valuable when more granular details are needed, but it also comes with risks. Suppliers providing self-reported data may report inaccurately, omit details or withhold information about their financial health. Without external validation, data may be unreliable and difficult to use for strategic decisions.

Share ownership between sourcing and data teams. While data teams are responsible for promoting data security, quality and access, they should also understand the importance of having a regular cadence with the sourcing teams. This is because sourcing team are on the front lines of supplier communication and will be the first to know about changes in supplier information (such as an address or certification change).

Additionally, shared ownership will streamline operations by preventing duplicative work and ensuring there is a single source of truth across supplier-based data sets.

Following these guidelines can help shift future supplier data curation in your favor. Nevertheless, it is just as important to assess the existing pain points in your data management workflow.