Supply Chain Roundtable: Risk or Treat

The quintessential Halloween song — “Monster Mash,” the 1962 single by Bobby “Boris” Pickett and the Crypt-Kickers — is an ideal soundtrack for this month’s gathering of roundtable of experts from Institute for Supply Management® (ISM®).

I was working in the lab, late one night

When my eyes beheld an eerie sight

For my monster from his slab, began to rise ...

For supply management professionals and their companies, risk is the monster that regularly mashes — and it’s hardly a procurement smash. The roundtable discusses the growing and worrisome trend of financial risk, then lightens the mood and gets in the spirit of the spooky season by sharing their choices for a supply chain-themed Halloween costume.

But first, as promised last month, the panel — Thomas W. Derry, ISM CEO; Jim Fleming, CPSM, CPSD, Manager, Product Development and Innovation; Michelle Rohlwing, MBA, Manager, Product Development, Innovation and Learning; and Linda Aaron, MBA, Subject Matter Expert — addresses news from the U.S. Federal Reserve that broke just before the September edition was published.

Q: The long-awaited interest rate cut has finally arrived, but some supply chain experts and ISM’s Business Survey Committee Chairs expect little impact at this point. Has the rate cut, with others likely to follow, helped companies and their supply management organizations or encouraged investment? And if not now, when?

Fleming: While the interest rate cuts are good news for corporations, I believe tariffs will continue to dominate supply chain focus. With so many companies being sensitive to quarterly earnings, tariffs have a more immediate impact on cost of goods sold (COGS) and profit margins. Tariffs also have ongoing fluctuations and uncertainties that supply chain professionals are dealing with. Recent ISM® PMI® Reports data and Business Survey panelist comments highlight the tariff tensions and suggesting the interest-rate cut will have longer-term implications when capital equipment and expansion are reconsidered.

Derry: The cost of capital, prevailing interest rates, is only one factor in an investment decision. In the current environment — really, for all of 2025 — demand signals have been so consistently weak, it might not make sense to invest in capital expenditures, even with interest rates coming down. An exception might be if significant efficiency gains would improve margins; a case could be made for that type of investment in the face of weak demand. Anything else will be postponed until economic uncertainty is resolved.

Rohlwing: The recent rate cut was a good step, but it hasn't moved the needle yet for a lot of companies due to other uncertainties like inflation, labor and tariffs. Many are still holding off on big investments. However, cheaper borrowing can help with cash flow and make supply chain finance more appealing. If things settle down and a few more cuts come through, I think we could see some more action in the next year.

Q: ISM’s recent risk webcast was dominated by discussion of financial risk, even more so than tariffs and surprise disruptions like the plant fire in Oswego, New York. How big of a concern is financial risk for companies, especially if the economy sputters?

(Editor’s note: Derry co-hosted the webcast with James Gellert, executive chair and former CEO of RapidRatings International.)

Derry: We’ve been waiting for this shoe to drop for a while. Private companies are generally under more financial strain and stress than public companies, and many if not most suppliers are typically smaller and private compared to their customers. Public companies have decreased their leverage and improved their interest rate coverage ratios over the last couple of years. Private companies are moving in the opposite direction.

As for consumers, debt levels become unsustainable for companies at some point. That’s what apparently happened with First Brands. The speculation in that case is that assets (specifically, accounts receivable) were pledged as collateral on multiple factoring deals, meaning that a default on one deal would mean default across all deals looking to access the same collateral. Understanding supplier financial health is a skill set we need to improve as a profession.

Rohlwing: Whenever the economy is showing signs of slowing down, businesses worry about cash flow, rising costs and supplier stability. If conditions get worse, financial pressures can spread throughout supply chains and could cause some real disruptions. This topic is top of mind for a lot of organizations and individuals right now.

Fleming: The supplier financial distress trends presented by James Gellert were eye-opening statistics. Building off Michelle’s answer, cash flow is critical with supply chains — and the further up the chain you look, the higher the risk. And when companies are trying to preserve their own cash flow by extending payment terms, it exacerbates the bullwhip effect. This should be a call to action for companies to proactively look at supplier financial health, whether using their own data collection or through third-party services such as RapidRatings.

Supply chain professionals should also be looking beyond the first-tier suppliers and reevaluating single-source or sole-source strategies. Revenue preservation and risk mitigation are aspects of strategic value that our professional can bring to the enterprise.

Aaron: Financial risk has come back to the forefront for many companies. For years, low interest rates and easy credit masked weaknesses in balance sheets. Now, with higher borrowing costs and inflation pressuring margins, those vulnerabilities are starting to show.

The greatest strain is on private and middle-market suppliers. The core of most supply chains. Many of these firms are overleveraged and less transparent, which makes early warning difficult. As bankruptcies rise, we’re seeing how one failure in the middle of the network can quickly ripple through an entire supply chain. Smart organizations are responding with more visibility and collaboration. They’re connecting finance and supply chain data, using analytics to catch early signals, and strengthening relationships with suppliers. This isn’t just about monitoring; it’s about real partnership and proactive communication.

Ultimately, this moment is a reset. It’s pushing companies to be more disciplined, to understand the financial health of their supply base, and to build resilience that goes beyond logistics and cost. Those who treat financial strength as a shared responsibility will be the ones who stay steady when the market gets rough.

Q: You’ve been invited to a supply chain-themed, costumes-required Halloween party. Who/what are you going as and why?

Aaron: I would dress as a large clock, with a nametag saying, “Just in Time” — the perfect supply chain-themed Halloween costume! Beyond the fun, it highlights a core supply chain principle: reducing financial risk through efficiency. Just-in-time minimizes excess inventory, tightens cash flow control and limits waste, helping companies stay agile and solvent when markets tighten. It’s not only an operational discipline, but also a financial safeguard that turns timing into a competitive advantage.

Rohlwing: Halloween is my favorite. I would dress up as a warehouse picker/packer, which was one of my jobs in college. I would wear a hard hat and a safety vest with “out of stock,” “delayed” and “rescheduled” stickers all over it. Or maybe I would go as an empty pallet. Both costumes could be symbolic of all the chaos happening in supply chains.

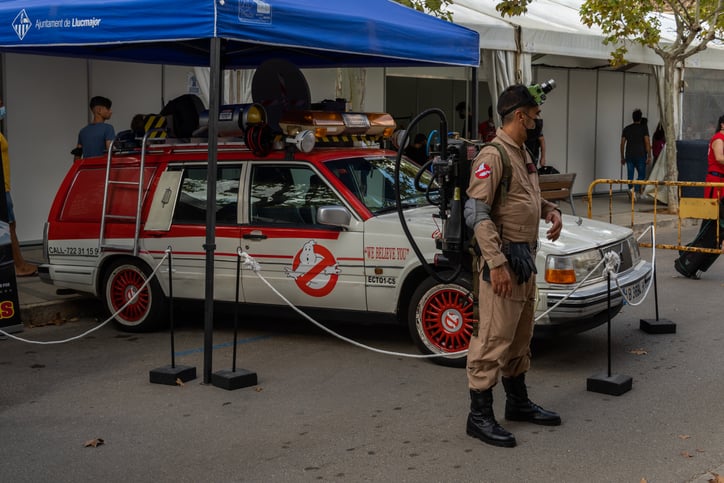

Fleming: I’d dress as a Ghostbuster. Corporate profit margins and revenues continue to be threatened by disruptions (paranormal threats) across all industries. Ghostbusters represent the group of eccentric scientists (procurement and supply chain professionals) that develop high-tech equipment (ERP, artificial intelligence, software-as-a-service) to detect and trap ghosts (price increases, late deliveries, single source suppliers) and battle the forces of nature (tariffs, geopolitical tensions, wars, earthquakes, floods, pandemics).

Derry: Tempting to say Captain America in the current environment, but I will go with Superman. “Able to leap tall buildings in a single bound.” That’s what supply chain superheroes do, week in and week out.