The Nine Ps of Supply Chain Value Propositions

Editor’s note: This is the second in a series of articles detailing insights about how disruption has impacted production and manufacturing, suppliers, inventory and other supply chain dynamics in China. In early July, author Ji Li, MBA, C.P.M. traveled to the Shanghai area and interviewed business owners, manufacturers and other supply chain professionals about their experiences over the past few years. The first article, “How Tariffs Are Impacting A Chinese Factory” can be read here.

***

Chinese manufacturers have weathered two decades of trade turbulence through adaptation and resilience. But what specific mitigation strategies are survivors deploying today?

“We diversified our customers and supply chain,” states general manager Yinhao Li of SYJ Molding. With exports having fallen from 60 percent to 20 percent of his business, his company diversified by capturing domestic business from shuttered competitors.

My visit to dozens of Chinese manufacturers in July revealed a consistent pattern: Companies that treat supply chain strategy like marketing campaigns survive better. “Supply chain is the new marketing,” Li observed — and he’s right.

The Nine Ps in Action

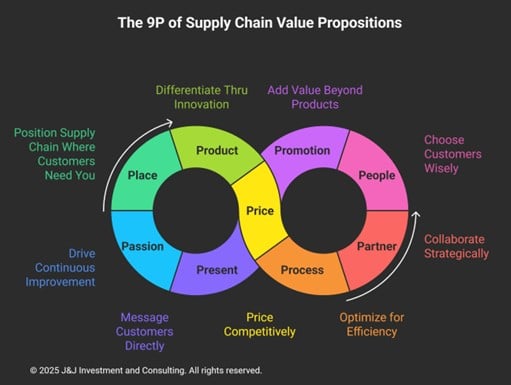

Just as marketers use the “nine Ps of marketing” to reach customers, savvy Chinese suppliers now leverage the nine Ps of supply chain value proposition to navigate tariffs and geopolitics. Whereas marketing’s nine Ps focus on customer acquisition and retention, supply chain’s nine Ps target resilience and value creation.

The figure below shows the nine Ps and how they interact.

(Used with permission from J&J Investment and Consulting)

Let’s delve further into the nine Ps, with examples and comments from Shanghai-area manufacturers I spoke with.

Place. Position supply chain where customers need you.

Chinese enterprises are aggressively expanding overseas. China’s Ministry of Commerce reports 2024 foreign direct investment reached US$143.9 billion, up 10.5 percent from 2023. SR Technologies exemplifies this strategy: Its new U.S. cable plant, operational last year, shields American customers from tariffs.

Product. Differentiate through innovation.

Facing competition from Vietnam, India and domestic rivals, manufacturers innovate. JD Metal Crafts, a hand-made model car producer with 150 employees, offers more than 10,000 SKUs and refreshes 20 percent of its lines annually. “Speed to market differentiates us,” owner Liang Ye explained. YKS Christmas Tree focuses on proprietary materials, stating, “We aim to be first to market. Our technical know-how is hard to duplicate.”

Price. The last resort trap.

With reduced U.S./European Union (EU) orders and heightened risks, manufacturers slash prices. China’s producer price index shows a 4.3 percent year-over-year decline, accelerating from a previous reading of 0.8 percent contraction. Such a situation eliminates weak players. For example, Shanghai Longki Garment, unable to cut further, saw revenue drop 50 percent.

Process. Optimize for efficiency.

Facing pricing pressure, manufacturers embrace automation and artificial intelligence (AI). SYJ Molding, for instance, operates 30 percent more efficiently than the industry average through continuous automation investment. Industrial AI provider Lead Digital reports 50 percent year-over-year demand growth across aerospace, equipment and energy sectors.

Partner. Collaborate strategically.

“Milk runs between China and Vietnam are common,” explains logistics expert Wayne Zhang. “Truckers deliver materials to Vietnam factories and return with fruits and seafood.” This collaboration cuts logistics costs and improves reliability over sea transport. Century 3 Construction plans joint ownership structures to boost employee morale and innovation.

People. Choose customers wisely.

“We’re very selective,” says Ye. Facing cancellation risks due to sudden tariffs, JD Metal Crafts works only with long-term U.S. customers with excellent credit. “We sometimes demand significant down payments to avoid being stuck with inventory,” she says.

Promotion. Add value beyond products.

When building plants for a technology client, Century 3 recommended adding recreational facilities. “This reduced their employee turnover and created a recurring relationship,” says Lan Zhang. “We constantly seek ways to add customer value.”

Presentation. Enable direct customer messaging.

China Customs data shows cross-border e-commerce grew 5.7 percent in the first half of 2025. New registrations jumped 173 percent, indicating businesses’ eagerness to present products directly to end customers, bypassing traditional intermediaries.

Passion. Drive continuous improvement.

Some view tariff pressure as a catalyst. “Never blame the environment,” advises Century 3’s co-founder. Jingtai Garments’ general manager Moon Xiao agrees, saying, “Tariffs force us to focus on internal optimization.”

The Strategic Shift

Across industries and sizes, Chinese suppliers are transforming supply chain operations from back-end support into proactive value creators. Like marketing teams, they strategically position where customers need them, partner throughout value chains, enable competitive pricing through optimization, and establish direct customer communication infrastructure.

For U.S. supply chain professionals, these insights reveal how your Chinese suppliers are evolving. More importantly, they offer a comprehensive framework for evaluating long-term supplier viability.

Apply the nine Ps as a supplier value assessment. Does your supplier have global positioning (place)? Innovate beyond requirements (product)? Maintain pricing through value, not margin cuts (price)? This comprehensive view predicts which partnerships thrive during next disruption.

Adopt the nine Ps internally. How do you showcase supply chain capabilities (presentation)? What value-added services differentiate you (promotion)? How do you collaborate internally and externally (partner)?

Suppliers leveraging these nine Ps won’t just survive the current trade environment — they’ll emerge as indispensable strategic partners, offering comprehensive solutions that create mutual value in an increasingly complex global market.