How Tariffs Are Impacting A Chinese Factory

Editor’s note: This is the first in a series of articles detailing insights about how disruption has impacted production and manufacturing, suppliers, inventory and other supply chain dynamics in China. In early July, author Ji Li traveled to the Shanghai area and interviewed business owners, manufacturers and other supply chain professionals about their experiences over the past few years.

***

The boiler’s 7 a.m. failure meant US$28,000 lost — another 2025 emergency Min Zhang couldn’t afford. The 38-year-old Kunshan SK Garment (SKG) plant manager has survived two decades of trade wars, pandemics and currency shocks.

But as President Donald Trump’s latest tariffs gutted his last U.S. orders and his wife’s pregnancy entered its final month, this broken machine threatened more than production: It risked his factory, his team, and his fragile hold on stability.

Zhang’s story mirrors the evolution of China’s manufacturing sector.

The Early 2000s

After high school, Zhang moved in Shanghai from rural Anhui in 2005, chasing factory jobs after China’s World Trade Organization entry ignited an export boom.

As trade tensions mounted with the U.S., China shifted from a fixed currency to managed float and revalued the yuan by 2 percent overnight. This was followed by a continuous 15-percent appreciation over the next decade — slashing exporters’ margins. The tight job market made Zhang grateful for his entry-level position at SKG, sewing pants for $220 a month.

Determined to advance, Zhang worked 10- to 12-hour days, including weekends, mastering every production process. When the 2008 financial crisis decimated U.S. orders, he watched as colleagues lost jobs. He worked even more efficiently to survive layoffs.

Hope came in 2010 when stricter enforcement of China’s Labor Law of 1995 took effect. “My wage grew at double-digit rates yearly from 2010; overtime doubled my pay, holidays tripled it,” Zhang recalled. Promotion to supervisor followed, but U.S. orders never fully recovered.

Adapting Through the China-Plus-One Era

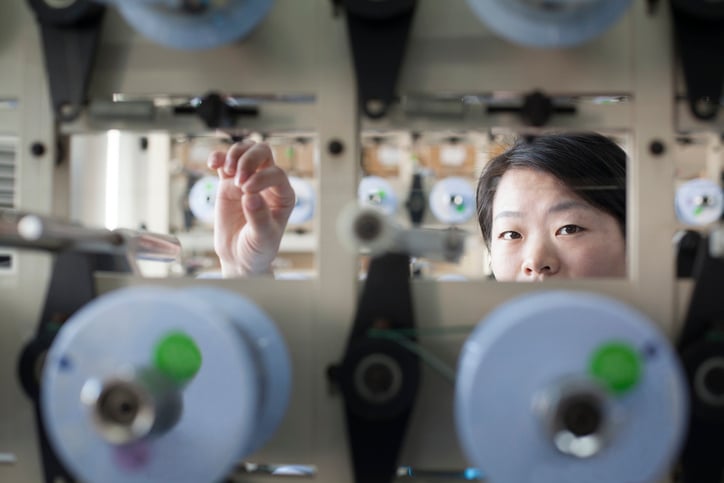

The China-plus-one diversification strategy emerged in the 2010s. As labor-intensive productions like textile and toy shifted to Vietnam and Cambodia, SKG pivoted to high-margin specialized garments.

“The shift maintained our profitability but shrank our business,” Zhang explained. Competition intensified from both domestic and international players.

Trump’s 2018 tariffs accelerated the bleed. While larger competitors established overseas plants, capital-constrained SKG relocated to cheaper Kunshan, one hour from Shanghai. Zhang, now a manager and middle-class professional, saw his workload explode.

“U.S. customers were always preferred: large volumes, reliable payments,” he said wistfully. “Now we chase smaller orders; same overhead, double the headaches.”

Innovation Through Adversity (2020–24)

When COVID-19 killed orders for some manufacturers, SKG scrambled for Middle Eastern and Africa clients. Zhang’s boss outsourced half the company’s production to reduce fixed costs while Zhang focused on staying ahead through product innovation.

“We replace 30 percent of our product line yearly. Customers find newer, better designs here than with competitors,” Zhang said. He credits SKG’s survival to team resilience and operational agility. “I’ve seen many ups and downs over 15 years. If we stop evolving, we die.”

His personal life evolved — marriage, an apartment, a baby on the way — even as his professional world contracted.

The 2025 Reality

But 2025 feels different. Trump’s second-term tariffs made China manufacturers reluctant to accept new American business. “This turned competition for non-U.S. orders into a hunger game as now more manufacturers chase the same customers,” Zhang said.

SKG’s staff shrank from 400 to 50 and gross margins hover in low single digits. Zhang juggles tripled duties while prepping for parenthood: “The labor market discards men my age,” he said. “I have to figure it out.”

He's already exploring a food take-out business as Plan B.

Zhang’s journey illustrates the reality: While 2025’s tariff impacts are significant, Chinese manufacturers have navigated similar turbulence for decades. Many will close, but the resilient will pivot.

For supply chain leaders, Zhang’s story offers timeless lessons: Resilience comes from operational flexibility, continuous improvement and the willingness to constantly reinvent your business model.

As the repaired boiler hums, Zhang plans that night’s production. His sonogram glows on his phone — a reminder that adaptation isn’t just about surviving today’s challenges, but also building tomorrow’s possibilities.