April 2025 ISM® Report On Business®: Manufacturing

PMI® at 48.7%

Economic activity in the manufacturing sector contracted in April for the second straight month of expansion preceded by 26 straight months of contraction, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

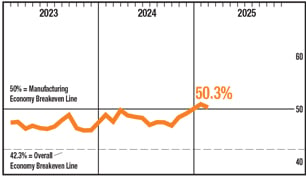

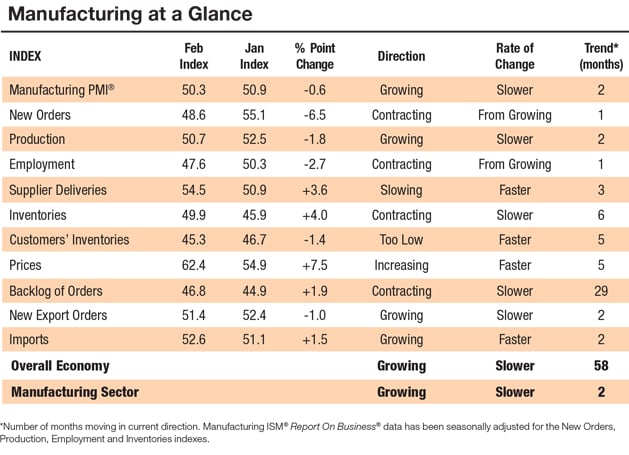

The Manufacturing PMI® registered 48.7 percent. The overall economy continued in expansion for the 60th month after one month of contraction in April 2020. (A Manufacturing PMI® above 42.3 percent, over a period of time, generally indicates an expansion of the overall economy.) The New Orders Index contracted for the third month in a row following a three-month period of expansion; the figure of 47.2 percent is 2 percentage points higher than the 45.2 percent recorded in March. The April reading of the Production Index (44 percent) is 4.3 percentage points lower than March’s figure of 48.3 percent. The index dropped back into contraction after two months of expansion and eight months of contraction prior to that. The Prices Index remained in expansion (or “increasing”) territory, registering 69.8 percent, up 0.4 percentage point compared to the reading of 69.4 percent in March.

The 11 manufacturing industries reporting growth in April — listed in order — are: Apparel, Leather & Allied Products; Petroleum & Coal Products; Plastics & Rubber Products; Electrical Equipment, Appliances & Components; Textile Mills; Computer & Electronic Products; Nonmetallic Mineral Products; Miscellaneous Manufacturing‡; Machinery; Chemical Products; and Primary Metals.

The U.S. manufacturing sector contracted in April for the second consecutive month after two months of expansion preceded by 26 months of contraction. The Manufacturing PMI® registered 48.7 percent, 0.3 percentage point lower compared to the 49 percent reported in March. After reversing its recent momentum in March, the Manufacturing PMI® again registered below its reading in December. Of the five subindexes that directly factor into the Manufacturing PMI®, two (Supplier Deliveries and Inventories) were in expansion territory, the same as last month.

Commodities Reported

Commodities Up in Price: Aluminum (17); Aluminum Products (2); Brass (2); Construction Materials; Cooking Oils; Copper (3); Corrugated Boxes (2); Critical Minerals (2); Electrical Components (3); Electronic Components (3); Maintenance, Repair, and Operations (MRO) Supplies; Packaging (2); Personal Protective Equipment (PPE); Plastic Resin (3); Power Train Products; Road Freight; Steel (3); Steel — Hot Rolled (3); Steel — Stainless (2); and Steel Products (2).

Commodities Down in Price: Gasoline and Diesel Fuel; and Natural Gas (2).

Commodities in Short Supply: Electronic Components (2); Plastic Resin; and Semiconductors.

Note: To view the full report, visit the ISM® Report On Business® website at ismrob.org. The number of consecutive months the commodity is listed is indicated after each item.