April 2025 ISM® Report On Business®: Hospital

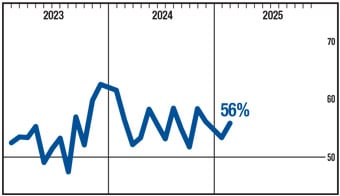

PMI® at 55%

Economic activity in the hospital subsector grew in April for the 20th consecutive month after contracting twice in the previous four-month period, with 35 consecutive months of growth prior to that, say the nation’s hospital supply executives in the latest Hospital ISM® Report On Business®.

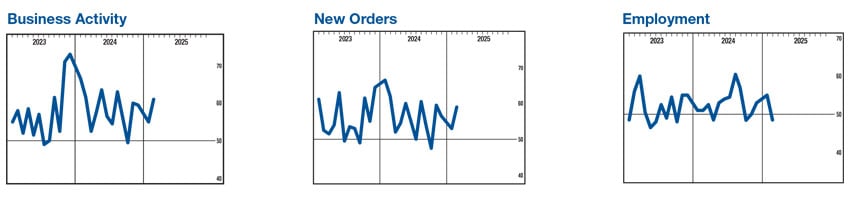

The Hospital PMI® registered 55 percent in April, a 4-percentage point increase from the March reading of 51 percent. The Business Activity Index remained in expansion territory for the sixth straight month. The New Orders Index expanded for the sixth consecutive month, and the Employment Index returned to expansion territory in April after two straight months in contraction. The Supplier Deliveries Index returned to expansion (which indicates slower delivery performance) after contracting in the previous month. The Case Mix Index returned to contraction territory in April, registering 49.5 percent, a decrease of 5 percentage points from the reading of 54.5 percent reported in March. The Days Payable Outstanding Index remained in contraction in April, registering 49 percent, up 1.5 percentage points from the 47.5 percent reported in March. The Technology Spend Index reading of 56.5 percent is an increase of 1.5 percentage points compared to the 55 percent recorded in March. The Touchless Orders Index returned to contraction territory in April, registering 49.5 percent, down 2.5 percentage points from the reading of 52 percent reported in March.

Hospital Business Survey panelists, collectively, cited mixed results in April. Some respondents reported that elective surgical cases increased across some systems, leading to decreases in inventory levels, supplementing deliberate efforts at inventory reduction. Other hospital systems reported increased patient volumes due to seasonal illnesses, as well as expanded services that enabled increased focus on physician recruitment retention efforts. Regarding tariffs and potential impacts, there were some expectations that costs will increase significantly during the second quarter of 2025, particularly among IT-related items. This is a problem for providers, since many do not have the ability to raise prices to maintain margins. Some organizations have increased bulk buys in advance of tariffs; others have shifted, where possible, major category business to U.S. manufacturers. In some cases, panelists reported that their facilities are getting too many substitutions for out-of-stock items from distributors.

About This Report

The information compiled in this report is for the month of April 2025.

The Hospital PMI® was developed in collaboration with the Association for Health Care Resource & Materials Management (AHRMM), an association for the health care supply chain profession, and a professional membership group of the American Hospital Association (AHA).

The data presented herein is obtained from a survey of hospital supply executives based on information they have collected within their respective organizations. ISM® makes no representation, other than that stated within this release, regarding the individual company data collection procedures. The data should be compared to all other economic data sources when used in decision-making.

ISM shall not have any liability, duty, or obligation for or relating to the ISM® Report On Business® (ROB) Content or other information contained herein, any errors, inaccuracies, omissions or delays in providing any ISM ROB Content, or for any actions taken in reliance thereon. In no event shall ISM be liable for any special, incidental, or consequential damages, arising out of the use of the ISM ROB. Report On Business®, PMI®, Manufacturing PMI®, Services PMI® and Hospital PMI® are registered trademarks and trademarks of Institute for Supply Management®. Institute for Supply Management® and ISM® are registered trademarks of Institute for Supply Management, Inc®.

You shall not create, recreate, distribute, incorporate in other work, or advertise an index of any portion of the Content unless you receive prior written authorization from ISM. Requests for permission to reproduce or distribute ISM ROB Content can be made by contacting Rose Marie Goupil in writing at: ISM Research, Institute for Supply Management, 309 W. Elliot Road, Suite 113, Tempe, AZ 85284-1556, or by emailing rgoupil@ismworld.org; Subject: Content Request.