ISM®’s 2025 Salary Survey: Higher Pay and Changing Dynamics

Supply management professionals in general reported a slight increase in average salary last year, amid a work environment characterized by changing age demographics and a persistent gender gap.

The burning question every year when Institute for Supply Management®’s (ISM®) Salary Survey is released is, of course: Did salaries go up? But also of critical importance are whether the gender gap eased, how various roles and experience levels fared financially, and what experts think about the future of the profession and compensation.

The 2024 data did not disappoint, continuing the trend of overall average salary increases, albeit by a small percentage: 1.3 percent. CPOs, managers and experienced practitioners saw larger gains, but the gender gap still remains.

Dig deeper, and there is more to digest among the numbers, percentages and charts in the Twentieth Annual Salary Survey. The results reflect changing demographics, work routines and workplaces, says ISM CEO Thomas W. Derry. These shifts are impacting roles, leadership dynamics and more.

The Modest Salary Bump

It’s important to note that the Survey reflects 2024 experiences. It was conducted December 19 through February 10, prior to much of the impacts of the trade war and widespread tariffs, government agency job cuts and upheaval, geopolitical uncertainty and increased economic volatility that have characterized 2025 so far.

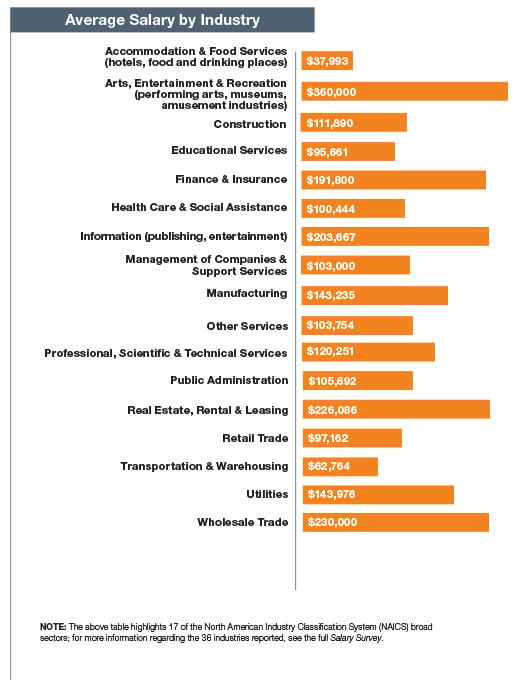

According to the Survey, the average overall 2024 compensation in the supply management profession was US$132,757, compared to $131,049 the previous year. The Survey also examined how much salaries changed: Respondents indicated a 4.6 percent increase, on average.

“The 20th edition of ISM’s Salary Survey reinforces the crucial and increasingly recognized nature of supply management work,” says Paul Lee, Director of ISM Research & Analytics. “The average salary again increased, and the reported change in salaries noted by respondents outpaced that of the general labor market (which was 3.6 percent, according to Payscale).”

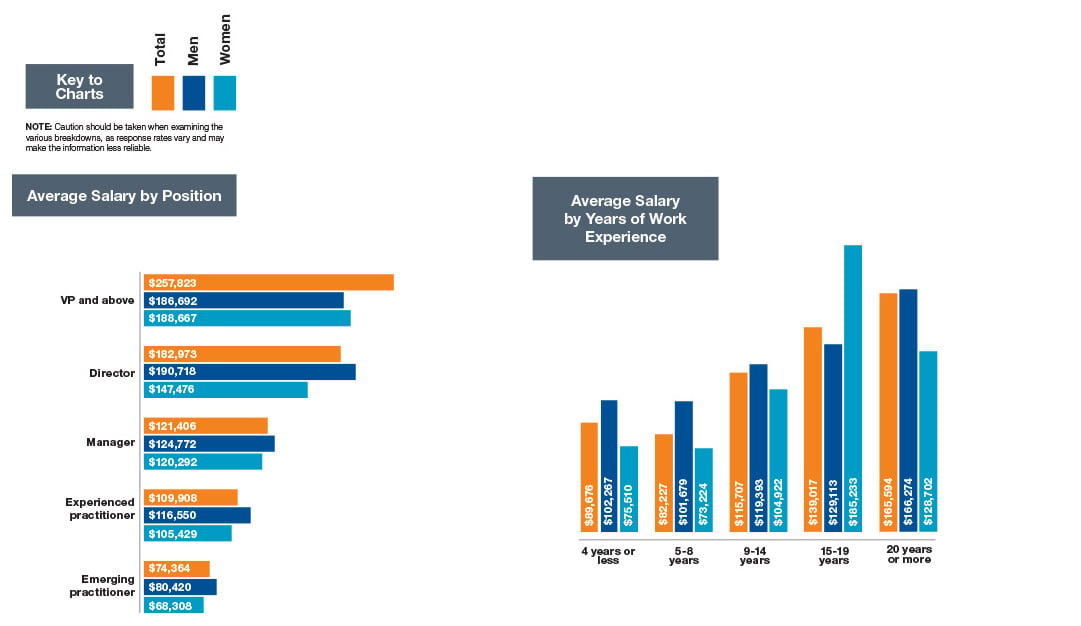

CPOs attained the largest gains in salary — 41 percent — while most other levels experienced more modest increases or decreases in average wages:

- Vice presidents: $264,789 in 2024, down from $265,942 in 2023

- Directors: $182,973, down from $186,773

- Managers: $121,406, up from $108,525

- Experienced: $109,908, up from $99,738

- Emerging: $74,364, down from $87,668.

Taking a closer look, CPO salaries experienced several years of decline, reaching as low as $126,042 in 2021, before climbing to $196,844 in 2023. Does the 2024 average of $278,085 mean those of the coronavirus pandemic years were blips?

No, Derry says. “Salaries were artificially depressed in 2021 and ’22,” he explains. “That could be because CPOs were being blamed — unfairly, I would say — for supply shortages. Now we’re back on trend. If you look at 2019 ($251,729) and run a straight regression line from there to 2024, we’re more or less on trend — and we’ve made up for lost ground.”

A mindset shift in recent years could be an impetus for the increase in CPO salaries. “What we’ve seen in a lot of other data that ISM collects,” Derry says, “is that there generally has been a shift from focusing on cost to a focus on resilience. This means it’s more important to a company that items are in stock to make products or service customers. If the company doesn’t have what it needs, it can’t do that and it loses sales and market share.”

During the pandemic, companies began to more greatly appreciate what they always had taken for granted, he says. “Previously, components were more readily available, and as a result, cost was the driving factor,” he says. “So, the current trend of emphasizing resilience over cost dictates that a CPO skill set or chief supply chain officer skill set is more appreciated. Companies realize that if they didn’t have good people doing that work, they wouldn’t be in business. It’s that existential. And it’s being reflected in the compensation.”

Age-Old Differences

Demographics also impact salaries, and the workforce is experiencing a demographic turnover. Boomers have always been a disproportionately large generation — with more people born between 1946 and 1964 than in preceding or succeeding generations. But if they haven’t done so already, boomers are retiring.

According to the U.S. Department of Labor, in the first quarter of 2018, boomers made up 25 percent of the labor force; six years later, that percentage dropped to 15 percent. Over the same period, millennials’ representation rose slightly, from 35 percent to 36 percent, while the Generation X workforce decreased 2 percentage points, to 31 percent.

“As boomers age out,” Derry says, “two things are happening. One, we’re seeing a natural rotation in terms of compensation because younger generations haven’t yet reached the levels of compensation held by boomers. We’re also seeing a natural rotation in leadership opportunities — and younger workers are having to step into leadership roles a little earlier than they would have done in a previous generation. Boomers were groomed longer before they were given the responsibility of managing people for the first time.”

ISM Subject Matter Expert Paul Archiopoli, C.P.M., CPSD, adds, “Keep in mind that every boomer will be retirement eligible by 2030, so being highly qualified and credentialed will help you take advantage of this demographic shift.”

The average age of Salary Survey participants was 49, Lee says, nominally higher than that of last year (47.5), indicating slightly more experience. The Survey, which didn’t delineate compensation by generation, did capture years of experience. Those with 35 or more years of experience — mostly boomer equivalents — averaged $222,631 in wages, while workers with 20 to 24 years of experience (Gen X/millennial mix) earned an average of $171,062. Those with 25 to 34 years’ experience (Gen Xers) averaged $141,989.

Although the percentage of boomers in the workforce has dropped in recent years, there are still a substantial number of workers in their 60s and 70s. Of late, boomer dynamics in supply management, Derry says, have been driven by two things:

- “The stress of what we do is causing some people to say they’ve had enough — that the pandemic was incredibly difficult — and so they’re going to do something else or play with their grandkids, or whatever it might be,” he says.

- “But another part of the generation is hanging on to their work longer than previous generations. Their health is good. They’re thinking, ‘What else am I going to do? My job is satisfying to me. Why would I retire even though I can?”

On one hand, Derry says, that’s to be commended. “Yet it does create gridlock at the top. It means fewer upper mobility opportunities for those underneath them,” he says.

The Gender Gap

The World Economic Forum’s Global Gender Gap Report 2024 states that while women have made gains in the general workforce, the playing field for representation and pay continues to lean toward men. “Based on current data, it will take 134 years to reach full parity,” the report states. That’s roughly five generations.

In supply management, according to the Salary Survey, the gender salary gap widened, increasing to 34 percent, 9 percentage points greater than last year’s gap. In 2024, men earned $144,384 on average, compared to $107,878 for women. Salaries for men increased from an average $140,559 in 2023, while those of women dropped from $112,761 on average.

Two factors, which had their start during the pandemic and are still playing out, could be contributing to the gender gap, Derry says.

The first: “Women, disproportionately compared to men, opted out of the workforce to take care of their elderly relatives or their young kids, causing them to fall behind a little bit of the pay scale,” he says. “But the argument against that is if you are hired as a director over category management, your previous salary history shouldn’t be that relevant. But it often is.”

Also, job applications typically ask for salary history. “Companies can use that against you because they think they can offer you what you’d consider good salary bump instead of paying you at market rate,” Derry says. “I would suggest that’s unfair. Why would I pay Sarah less to do the same job than I pay Sam? Why would what you pay for that job be different depending on who’s sitting in the chair? … I don’t think anyone disagrees with the idea of equal pay for equal work.”

Other Findings

In other Salary Survey items of note, separate from compensation:

Information sharing. There are definite generational preferences in terms of how workers prefer to consume information. Some generations prefer interpersonal or written communication, others email, and still others instant messaging (IM).

“For most people, IM-ing is going to be the communication vehicle of the future,” Derry says.

What’s most important? As was expected, the Survey indicated wages, work/life balance, job satisfaction and benefits packages are top priorities for supply managers. “They’ve been the top priorities for over 10 years,” Lee says.

Other factors — including physical work location, supportive coworkers, company-provided training and educational opportunities — gained slightly in their priority among workers (while still ranking below the top five). This could reflect the rise in use of advanced technologies like artificial intelligence (AI) and the need for training, as well as attention being given to hybrid working environments and collaboration.

Benefits. The most important benefits offered by employers are health insurance, retirement planning and paid time off.

Bonuses. Like last year, nearly two-thirds (63 percent) of respondents received a bonus in 2024. However, bonuses overall were lower in 2024 than 2023.

Managed categories. Manufacturing materials, office supplies, electronics, capital equipment and indirect goods are the most commonly managed categories.

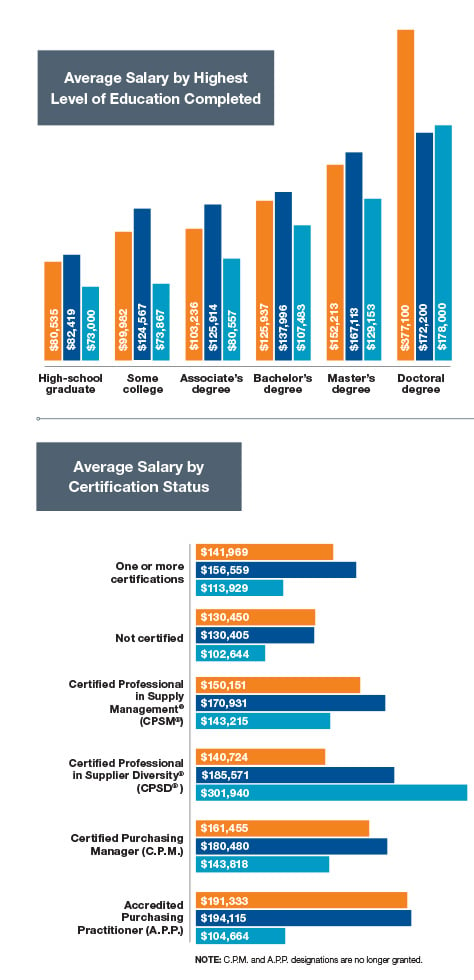

Certifications. “The value of certification is demonstrated by the $20,000 premium paid to respondents holding a Certified Professional in Supply Management® (CPSM®),” Lee says. Those with a CPSM earned $150,151, while non-certified respondents earned $130,450, a difference of 15 percent.

“It has never been more important for supply chain professionals to increase their value by taking the time to build their ‘talent stack’ by getting as much education and training as they can,” Archiopoli says. “Practitioners can directly increase their market value with professional certifications like CPSM or Certified Professional in Supplier Diversity® (CPSD®) and contemporary training in technologies, like AI prompt engineering, that make you more valuable.”