Pandemic Heightens Supply Chain Awareness, but Paper Invoices Remain

The saying goes that the only certainties in life are death and taxes. And the coronavirus (COVID-19) pandemic has shown that bills — or invoices — never stop coming, either.

For years, companies have been digitizing finance operations. But these transformative efforts take time, and they can still depend on how companies settle their invoices.

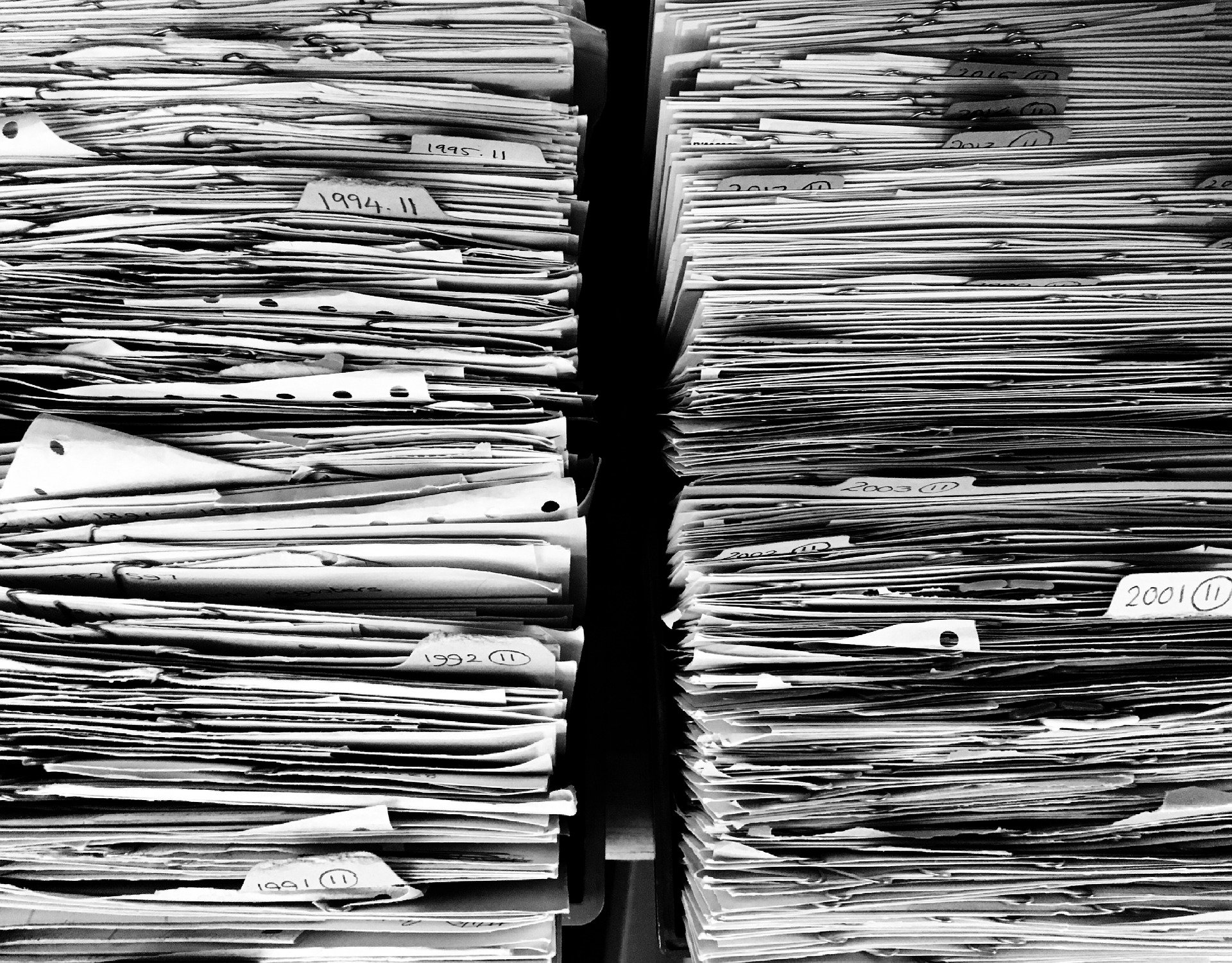

Despite even the best digital-finance efforts, the reality is that 80 percent of businesses still use paper checks to pay invoices. Did bills stop coming when the pandemic forced companies to move their payables teams to remote work? No. They piled up, and if a company was lucky, one person could regularly drive to the office and pick them up.

Fortunately, there was a heightened sense of camaraderie and leniency in the business world during the worst of the pandemic, as the backlog of invoices and cash-flow concerns were acknowledged.

A 2020 study by management consulting firm McKinsey & Company tracked how industries were affected by the pandemic. Some companies — like those making personal protective equipment (PPE) and toilet paper — saw a huge surge in demand, and others (travel and hospitality) saw an unprecedented and significant drop in demand. Still others saw an uptick not directly related to COVID-19, but more in response to people’s changing behaviors — for example, home improvement retailers as people spent more time working remotely.

An example of the surge problem was the global PPE shortage, which, exposed newly identified constraints within supply chains. For many companies, PPE is considered indirect spend, meaning they lack strong supply chain relationships or strategies to procure these products. Organizations experience supply outages because most disaster-recovery plans don’t account for global catastrophes — they’re typically focused on regional issues or acts of God.

Although emergency rules were put in place during the pandemic, expect a new element of disaster-recovery planning tied to localization and self-sufficiency as the emergency recedes. Organizations are now cognizant of (1) how quickly production can be shut down on a global scale and (2) the need to find ways to keep individual locations operational.

For instance, companies turned to digital marketplaces in large numbers. In August 2020, Joe Cicman, senior analyst at Forrester Research Inc., told Digital Commerce 360, “We saw B2B sites using marketplace models to rapidly add personal protective equipment to their assortment without sourcing the inventory, without buying the stuff wholesale, without managing the product details.” This approach, of course, presented its own challenges, but it describes how businesses push to find ways to get what they need.

For teams overseeing digital-finance transformations, the tune evolved from focusing purely on ROI and efficiency gains to understanding the bigger picture, including cost reduction. Conversations that once centered on reducing the price of an invoice from US$12 to $2 are now focused on automating payables-department tasks and allowing the team to take on more strategic roles.

With a heightened focus on both top and bottom lines, the COVID-19 pandemic has made the digital-finance conversation a top-line agenda item by exposing the bottleneck with paper-based invoices and highlighting opportunities for fraud, time lost and payment-term issues.

It’s 2021, and regardless of a global pandemic, the fact that some companies are still physically managing thousands of invoices per month sent via snail mail is a tangible problem that warrants discussion at the executive level.