Inside Supply Management Magazine

The Monthly Metric: SWOT Analysis

Welcome to the second installment of The Monthly Metric, where we examine a piece of data that can help supply management professionals do their job more efficiently.

In our introductory post last month, we addressed how advanced analytics has taken over Major League Baseball, but is not as prominently used in procurement. This, according to survey results indicating that many supply management stakeholders don’t use performance metrics — or don’t trust the ones they have. Institute for Supply Management® (ISM®) wants to help reverse this trend, through this blog feature and such educational opportunities as Business Analytics for Procurement Workshop, a seminar June 12-13 in New York.

Jim Barnes, Managing Director of ISM Services, is the seminar instructor. He says that supply management’s data deficiencies were exemplified during a recent workshop he conducted for a company. When he asked whom among the 22 employees in the room used a spend analytics tool, only two people raised their hand.

“We were talking about a basic spend analytics tool — and one the company was offering to the employees for free,” Barnes says. “(Lack of reliable data) is a problem, and there are two main issues. First, most companies can’t get at the data as easily as you would think. Second, procurement professionals historically have not been oriented around managing and understanding data — even just spend data. What we find is procurement people are tied up in the tactical stuff, so they don’t have time for analytics, and more seasoned professionals don’t feel comfortable doing it.”

Getting comfortable with advanced analytics is easier when a supply management professional has a sound grasp of his or her organization’s capabilities, as well as the state of the market. In fact, that’s exactly where we’re going to start.

What Is SWOT Analysis?

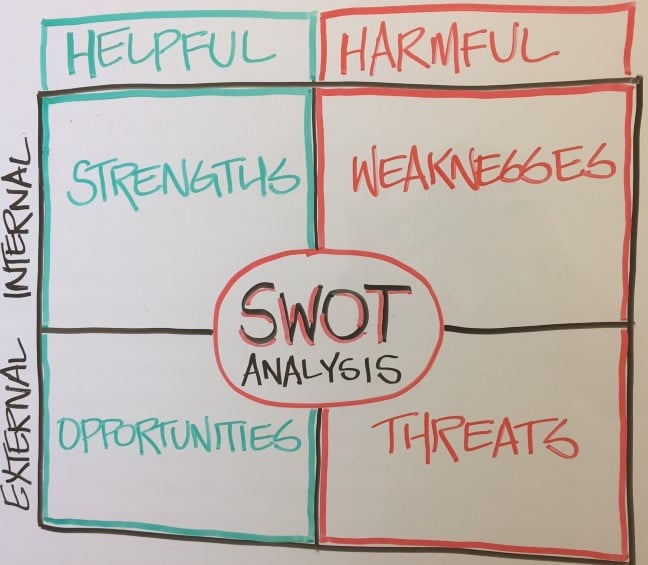

The fact that something created in the 1960s is considered an advanced analytic today speaks to the endurance and effectiveness of SWOT Analysis as a diagnostic framework for an organization. An acronym for strengths, weaknesses, opportunities and threats, SWOT helps provide a clearer picture of internal and external dynamics impacting procurement decisions.

Barnes says a SWOT Analysis is a good first step for (1) a procurement executive or supervisor joining an organization or (2) a company exploring new product initiatives or policy changes. Some organizations perform a SWOT Analysis on a regular basis, such as quarterly or annually. It can also be an effective way to analyze a competitor.

The analysis is represented visually as a square divided into four quadrants. At the top, the strengths and weaknesses quadrants reflect an organization’s personnel, financial and technology/infrastructure resources — those in abundance, and those that are scarce. If there are inconvenient truths about your company, this is a good time to confront them.

On the bottom, the opportunities and threats quadrants detail the market, economic, demographic, environmental and political trends that can impact an organization. A company should think of scenarios in which it can improve a product or expand its customer base, and determine what could go wrong. Factors related to suppliers and other partners are also classified as opportunities or threats.

“The thing that’s important to understand from a supply management professional is that you can’t control the external influences, you still must adjust to them,” Barnes says. “You can’t ignore them; they are part of the playing field that is always shifting.”

Case Studies

An organization can be brutally honest with itself about its strengths and weaknesses and perform a thorough assessment of the marketplace, filling in all four quadrants of the SWOT square with useful information. However, Barnes says, the true value of a SWOT Analysis comes with what happens next.

“Procurement professionals should gather data and information to get educated, then step back and use an analysis to look at the history and try to project what it means for the future,” Barnes says. “If gas prices have bottomed out, what will an increase mean to the component or product you want to buy? If you’re in a utility, how will that be affected? Look for data that is applicable to the category you want to manage. That’s a good introduction to your company as well as the market.”

Many companies — from startups to the most iconic brands in the world — have SWOT Analysis success stories.

Recently, ISM Services helped Altra Industrial Motion, a Braintree, Massachusetts-based power transmission equipment manufacturer, with a SWOT Analysis of the United Kingdom transportation and logistics sectors. The analysis sized up market growth in the U.K., evaluated shipping options and introduced the company to three new potential suppliers.

“We gave them the lay of the land,” Barnes says. “It was valuable for them to have that to be able to go out and do an RFP with the appropriate market players. Having that type of market analysis is a good precursor to any event in which you would market source.”

In 2015, New York-based investment researcher Value Line conducted a SWOT Analysis of The Coca-Cola Company, noting that the world’s largest beverage company was “set to plod along.” Coca-Cola’s profitability, Value Line indicated, was being hindered, primarily by the growing popularity of “healthier” drink choices.

Value Line cited “diversification” as one of Coca-Cola’s opportunities and “nutritious selections” as a threat. The company responded by further expanding its beverage portfolio beyond its trademark soft drinks and by boosting marketing efforts. While the costs of refranchising U.S. bottling operations have been a drag on full-year profit figures, the company’s stock, which was around $41 per share at the time of the analysis, climbed to $46 and is now around $43.

In a SWOT Analysis, honesty is the best policy. An organization that is not realistic about its assets or its place in the market will not get accurate, actionable data from the analysis. And that’s critical, Barnes says, to get the bird’s-eye view necessary for a company to ensure its next steps are in the right direction.

“What happens is that people can sometimes think so narrowly that they miss the big picture, and why a market analysis such as SWOT is so important,” Barnes says. “It helps you step back and see the bigger picture.”

To suggest a metric to be covered in May, leave a comment on this page, email me at dzeiger@instituteforsupplymanagement.org or contact us on Twitter: @ISM_Magazine.